WHY SAUDI?

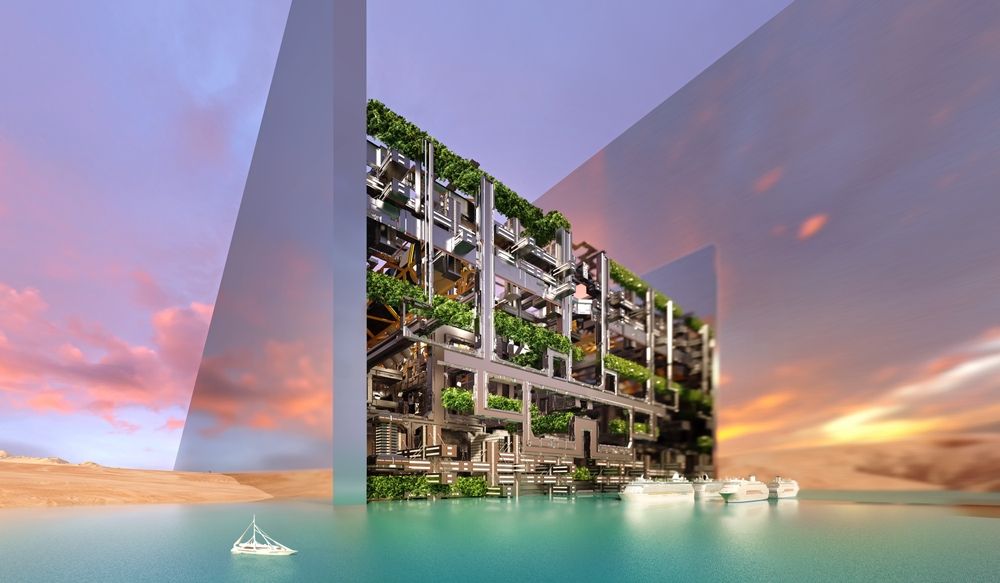

In recent years, Saudi Arabia has gained significant attention as a prime destination for property investment, especially among international investors seeking to diversify their portfolios. Driven by strong economic growth, large-scale development projects, and the ambitious Vision 2030 initiative, the Kingdom offers unique opportunities for UK-based property investors. Major cities such as Riyadh, Jeddah, and Dammam are undergoing rapid urbanization, supported by an expanding middle class and an influx of expatriates. The government’s push to reduce oil dependency has also spurred investments in infrastructure and real estate, further enhancing the market’s appeal. Relaxed foreign ownership regulations and tax incentives have made property investment in Saudi Arabia more accessible. Projects like NEOM, The Red Sea Development, and Qiddiya are redefining the Kingdom’s landscape, attracting global interest. With high demand for residential, commercial, and luxury properties, Saudi Arabia is positioning itself as a leading player in the global real estate market. For UK investors, this presents a golden opportunity to tap into a dynamic and evolving market with long-term growth potential.